Quarterly Forecasts

Story in 2018 and early 2019 was weak sales; story in 2020 will be lack of supply

Ottawa, ON, December 16, 2019 – The Canadian Real Estate Association (CREA) has updated its forecast for home sales activity via the Multiple Listing Service® (MLS®) Systems of Canadian real estate boards and associations this year and for 2020.

Evidence suggests housing activity will continue to improve into 2020, with prices either continuing to rise or accelerating in many parts of Canada. Indeed, many housing market indicators continue to support this outlook.

Additionally, the Bank of Canada is widely expected to not raise interest rates in 2020.

Mortgage interest rates have declined, including the Bank of Canada’s benchmark five-year rate used by Canada’s largest banks to qualify applicants under the B-20 mortgage stress-test. Though the decline in the benchmark rate has been modest, it is helping to improve homebuyer access to home purchase financing.

Source: CREA The Canadian Real Estate Association, Quarterly Forecasts https://www.crea.ca/housing-market-stats/quarterly-forecasts/

Canadian Housing Market Outlook

Average home price expected to rise by 3.7% next year

• Increased consumer confidence could be a key factor affecting the housing market in 2020

• 51% of Canadians are considering a home purchase in the next five years, up from 36% at the same time last year

• Only two in 10 Canadians say that the mortgage stress test negatively affected their ability to purchase a home in 2019

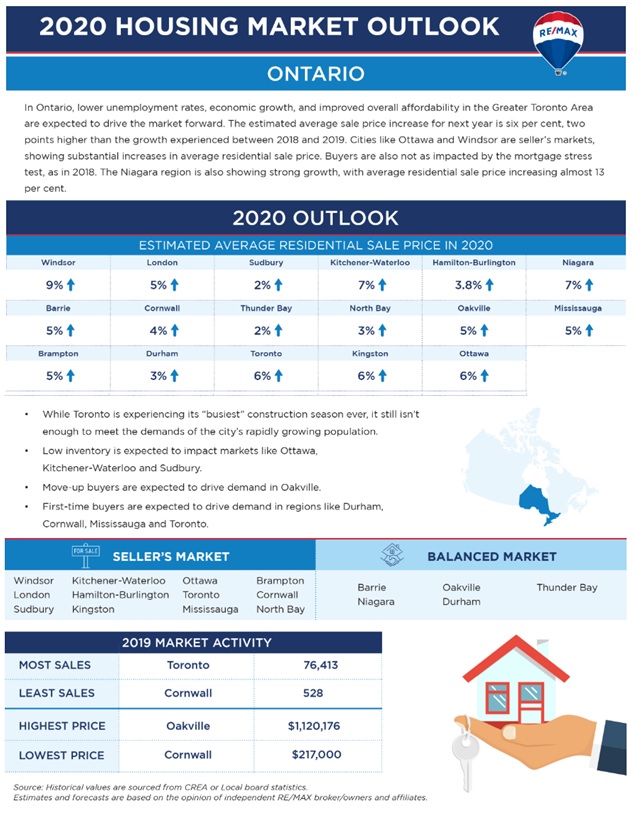

RE/MAX is calling for a leveling out of the highs and lows that characterized the Canadian housing market in 2019, particularly in Vancouver and Toronto, as we move into 2020. Healthy price increases are expected next year, with the RE/MAX 2020 Housing Market Outlook Report estimating a 3.7 per-cent increase in the average residential sale price.

RE/MAX is calling for a leveling out of the highs and lows that characterized the Canadian housing market in 2019, particularly in Vancouver and Toronto, as we move into 2020. Healthy price increases are expected next year, with the RE/MAX 2020 Housing Market Outlook Report estimating a 3.7 per-cent increase in the average residential sale price.

Most individual markets surveyed across Canada experienced moderate price increases year-over-year from 2018 to 2019. However, some regions in Ontario continue to experience higher-than-normal gains, including London (+10.7 per cent), Windsor (+11 per cent), Ottawa (+11.7 per cent) and Niagara (+12.9 per cent).

As more Canadians have adjusted to the mortgage stress test and older Millennials move into their peak earning years, it is anticipated that they will drive the market in 2020, particularly single Millennials and young couples. A recent Leger survey conducted by RE/MAX found that more than half (51 per cent) of Canadians are considering buying a property in the next five years, especially those under the age of 45.

Source: Canadian Housing Market Outlook, RE/MAX Canadian News https://blog.remax.ca/canadian-housing-market-outlook/